[ad_1]

There’s a distinction between notion and actuality. It’s logical to imagine international fund inflows assist drive up inventory costs and vice-versa. And that’s true to an extent, however if you happen to suppose you’ll be able to inform the place the market goes to go based mostly on how international funds are behaving within the money market, you’ve acquired a really robust process at hand. Let’s say, close to unattainable. Right here’s why.

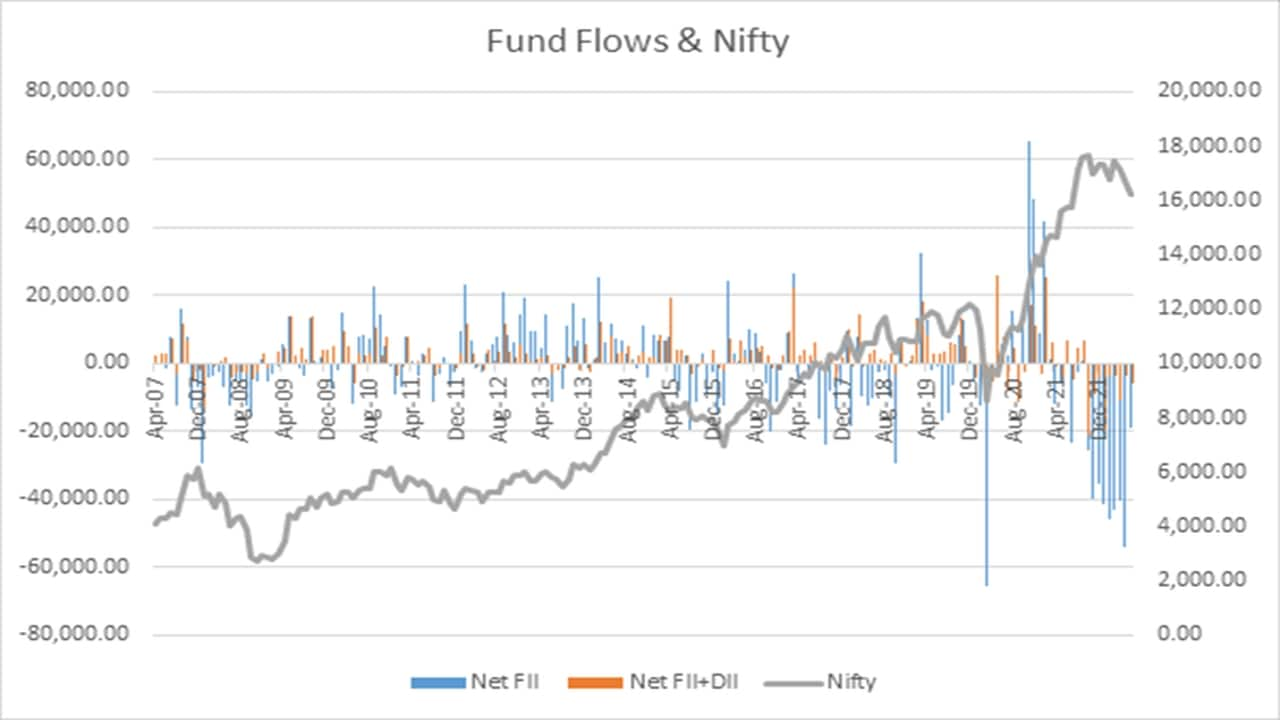

FPI FLOWS AND THE NIFTY

March 2022 was a month through which international buyers web bought shares value Rs 43,281 crore. In the identical month, the NSE-50 Index (Nifty) moved from close to 16,800 to over 17,400, a acquire of close to 4 p.c in a month. Equally, in December 2021, whereas the web international investor withdrawal was about Rs 13,500 crore, the Nifty ended with positive factors of two.2 p.c.

However that is simply anecdotal proof of divergence. A extra studied strategy reveals that since 2007, the correlation between web international cash flows and Nifty change is nearly a average 0.5 p.c. And that’s not a robust sufficient linkage to make use of as a foundation for forecasting market route.

The chart above reveals that whereas the markets have been uneven within the current previous, there hasn’t been a secular decline regardless of a transparent pattern of international fund outflows.

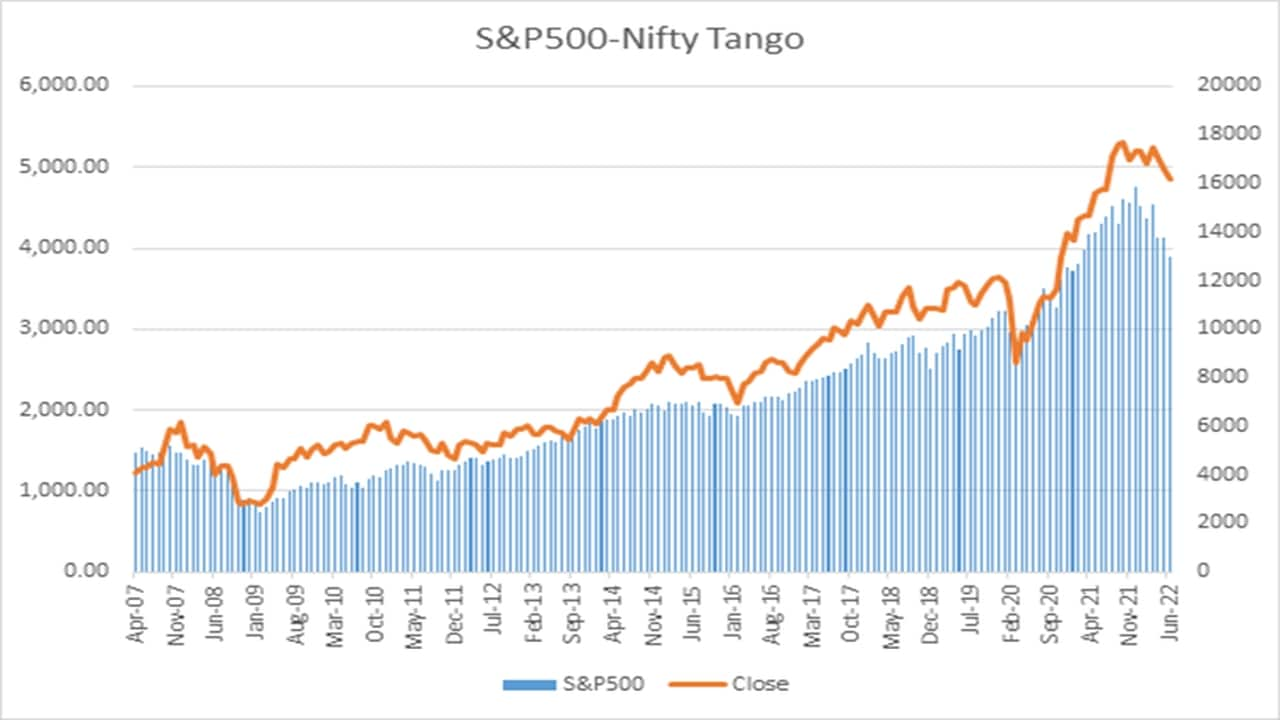

S&P-500 AND THE NIFTY

A significantly better gauge of the place the Nifty could also be headed is the US market. A have a look at the Commonplace & Poor’s 500 inventory index (S&P-500) reveals a robust synchronization with the Nifty. And that isn’t stunning. Like Uday Kotak lately tweeted, “When US sneezes, the world catches a chilly”, so do Indian markets swing to the US market tunes.

An analogous fast examine since 2007 to evaluate the correlation of the Nifty to the S&P-500 reveals a results of 0.98, which is sort of nearly as good because it ever will get. It suggests a close to 1:1 transfer within the Nifty in-line with the S&P-500. Therefore, a greater gauge of the place the Indian market is headed would emanate from US equities.

So, the place may we be headed?

SIGNALS FROM THE S&P-500

The S&P-500 noticed a pointy slide on Friday with the index ending close to 117 factors decrease, down 2.9 p.c. That’s delicately near a earlier closing low, additionally at close to 3900. After this fall, the S&P-500 is down 19 p.c from its excessive and really near getting into bear territory (a 20 p.c decline or extra). If that occurs, the sooner low of 3810 is a definite chance and an additional decline may even see the index slip to close 3500, which might spell an over 27 p.c decline. An analogous decline within the Nifty may take it nearer to 13600.

However keep in mind there are many ifs and buts right here. It isn’t straightforward to forecast market strikes, and least of all do it precisely or constantly. So, buyers ought to follow a disciplined strategy of both investing in index SIPs or, if they’ve the time and capability, by shopping for promising companies at engaging valuations and never worrying an excessive amount of about market swings.

Completely satisfied investing!

(Edited by : Priyanka Deshpande)

First Revealed: IST

[ad_2]

Source link