[ad_1]

It’s a sea of purple throughout. The worldwide fairness market was crushed down badly as they witnessed a powerful sell-off final week. The foremost indices throughout the globe have been down within the vary of 4-6 per cent. The sell-off was triggered within the second half of the week after the US Federal Reserve assembly end result. The Fed raised their fund charges by 75-basis factors (bps) very a lot in step with market expectation. The central financial institution had additionally hinted for a chance of one other spherical of 75-bps charge hike.

The Indian benchmark indices opened the week with a large gap-down however have been managing to remain afloat. However they fell sharply breaking beneath their essential helps on Thursday and closed the week on a weak be aware. Sensex and Nifty 50 tumbled over 5 per cent every. All of the sectoral indices closed in purple. The BSE Metals and the BSE Oil & Fuel indices, down over 9 per cent every, have been crushed down probably the most.

The International Portfolio Traders (FPIs) have been web sellers of Indian equities for the tenth consecutive week. They bought about $2.25 billion final week. With this, the web outflow for June stands at $4 billion.

Nifty 50 (15,293.5)

Nifty opened the week with a large gap-down beneath 16,000. It managed to maintain above the important thing assist degree of 15,645 within the first half of the week. However on Thursday, it tumbled breaking beneath that assist and made a low of 15,183.4 on Friday. The index has closed the week at 15,293.5, down 5.6 per cent.

Graph Supply: MetaStock

The week forward: The outlook is damaging. Nifty has room for an additional fall to 14,700-14,600 this week. Speedy assist is at 14,900. A break beneath it may possibly drag it to 14,700-14,600.

Nonetheless, Friday’s candle signifies near-term indecisiveness available in the market. This leaves the probabilities alive for a short-lived reduction rally within the close to time period. So whether or not Nifty will fall to 14,700-14,600 from right here itself or after a corrective bounce stays unclear.

Speedy resistance is at 15,400. If Nifty manages to breach this hurdle, a corrective rise to fifteen,750-15,770 is feasible this week. Nonetheless, an increase past 15,770 is unlikely. As such, we will anticipate the Nifty to reverse decrease once more from the 15,750-15,770 area and fall again in the direction of 15,000 initially. A break beneath 15,000 can drag it to 14,700-14,600 finally.

What to observe

Help at 14,700-14,200 on NIfty

Help at 49,000-48,000 on Sensex

Help at 31,835 on Nifty Financial institution

Buying and selling technique: Merchants can go brief now. Accumulate shorts on an increase at 15,680. Preserve the stop-loss at 15,890. Path the stop-loss down to fifteen,120 as quickly because the index falls to 14,920. Transfer the stop-loss additional right down to 14,820 when the index touches 14,740 on the draw back. Ebook earnings at 14,640.

Medium-term outlook: Essential medium-term helps are arising for the Nifty — 14,700-14,600 after which the 14,400-14,200 is the subsequent sturdy one. As such, the present fall can halt wherever within the broad 14,700-14,200 area. A robust bounce from this assist zone can take the Nifty as much as 15,500-15,700 initially. Thereafter, the value motion will want a detailed watch to see if the index is managing to rise previous 15,700 or will fall-back once more.

From a long-term perspective, the 14,700-14,200 area shall be a superb alternative to start out shopping for in small quantum. That’s, buyers can deploy 30 per cent of their supposed funding capital.

Buying and selling technique: Positional merchants can proceed to carry the brief positions taken at 17,171. Revise the stop-loss down to fifteen,850 from 16,100. Transfer the stop-loss additional down to fifteen,350 as quickly because the index touches 15,150. Ebook earnings at 15,100.

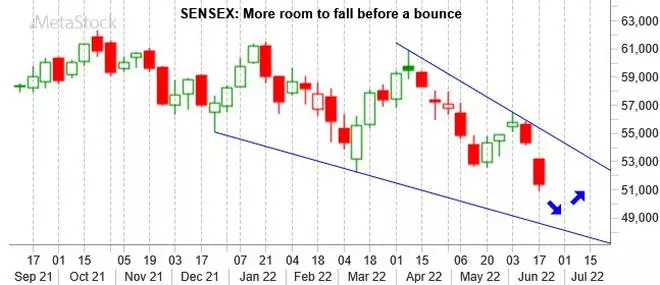

Sensex (51,360.42)

After opening with a large gap-down beneath 54,000, Sensex was managing to maintain above the essential assist degree of 52,400. However Thursday’s sell-off throughout the worldwide markets dragged the index sharply beneath that assist. Sensex made a low of fifty,921.22 and has closed at 51,360.42, down 5.4 per cent.

Graph Supply: MetaStock

The week forward: The outlook is bearish. Sensex can take a look at the psychological 50,000 market this week. A break beneath it may possibly drag it to 49,500 and 48,900 – the subsequent two necessary helps for the week.

Speedy resistance is at 51,650. If the Sensex manages to interrupt above it, a corrective bounce to 52,500-52,800 is feasible first, earlier than the above-mentioned fall to 49,500-48,900 occurs.

Medium-term outlook: Sturdy medium-term assist is within the broad 49,000-48,000 area. We anticipate the present fall to discover a backside wherever within the 49,000-48,000 area. A bounce-back from this assist zone can take the Sensex as much as 51,500-52,500 within the coming weeks. Thereafter the value motion will want a detailed watch to see if the Sensex can rise previous 52,500 or will reverse decrease once more and preserve the broader down development intact.

Nifty Financial institution (32,743.05)

The anticipated break beneath 34,000 and the autumn to 33,000 occurred at the start of the week itself. After hovering above 33,000 for a while, the Nifty Financial institution index tumbled breaking beneath 33,000 to make a low of 32,290.55 on Friday. It has closed the week at 32,743.05, down 5 per cent.

Graph Supply: MetaStock

The outlook is bearish. The 33,000-33,500 area shall be a superb resistance for this week. The upside may be capped at 33,500 in case of any intermediate bounce. The Nifty Financial institution index can fall to check 31,835 – an important medium-term assist.

The worth motion thereafter will want a really shut watch. A robust bounce from this assist can take the index as much as 33,500-34,000 once more. However a break beneath 31,835 improve the draw back strain. Such a break can then drag the Nifty Financial institution index right down to 30,000-29,500.

Buying and selling technique: Contemplating the risk-reward ratio, we desire staying out of the market this week.

International cues

As anticipated, the Dow Jones Industrial Common (29,888.78) remained properly beneath 32,000 final week. Additionally, the autumn to 29,850 has occurred in step with our expectation. The index tumbled 4.8 per cent final week.

The outlook is bearish. Speedy resistance shall be at 30,000. So long as the index trades beneath this resistance, the probabilities are excessive for the Dow to fall additional in the direction of 29,300 and even 28,950 within the brief time period.

The Dow should see a sustained rise previous 30,000 to get some breather and rise again in the direction of 31,000 and better ranges.

From a long-term perspective, 28,000-27,750 is a vital assist zone which might halt the present fall if it extends past 28,950.

Printed on

June 18, 2022

[ad_2]

Source link