[ad_1]

In the event you’re undecided the place to start out when searching for the subsequent multi-bagger, there are a couple of key developments you must preserve a watch out for. Ideally, a enterprise will present two developments; firstly a rising return on capital employed (ROCE) and secondly, an growing quantity of capital employed. Put merely, these kinds of companies are compounding machines, which means they’re regularly reinvesting their earnings at ever-higher charges of return. Nonetheless, after investigating Bellway (LON:BWY), we do not assume it is present developments match the mildew of a multi-bagger.

Understanding Return On Capital Employed (ROCE)

Simply to make clear in the event you’re not sure, ROCE is a metric for evaluating how a lot pre-tax revenue (in share phrases) an organization earns on the capital invested in its enterprise. To calculate this metric for Bellway, that is the system:

Return on Capital Employed = Earnings Earlier than Curiosity and Tax (EBIT) ÷ (Whole Property – Present Liabilities)

0.15 = UK£567m ÷ (UK£4.6b – UK£844m) (Based mostly on the trailing twelve months to January 2022).

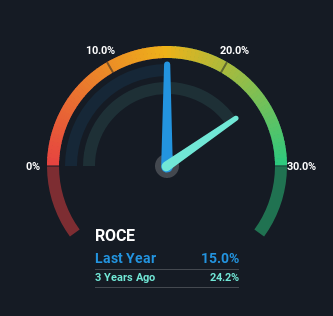

So, Bellway has an ROCE of 15%. By itself, that is a regular return, nonetheless it is significantly better than the 12% generated by the Shopper Durables business.

View our latest analysis for Bellway

Above you possibly can see how the present ROCE for Bellway compares to its prior returns on capital, however there’s solely a lot you possibly can inform from the previous. If you would like to see what analysts are forecasting going ahead, you must take a look at our free report for Bellway.

So How Is Bellway’s ROCE Trending?

Once we seemed on the ROCE development at Bellway, we did not achieve a lot confidence. Round 5 years in the past the returns on capital have been 25%, however since then they’ve fallen to fifteen%. Nonetheless, given capital employed and income have each elevated it seems that the enterprise is presently pursuing development, on the consequence of brief time period returns. And if the elevated capital generates further returns, the enterprise, and thus shareholders, will profit in the long term.

On a associated notice, Bellway has decreased its present liabilities to 18% of whole property. That would partly clarify why the ROCE has dropped. What’s extra, this could scale back some features of threat to the enterprise as a result of now the corporate’s suppliers or short-term collectors are funding much less of its operations. Because the enterprise is principally funding extra of its operations with it is personal cash, you possibly can argue this has made the enterprise much less environment friendly at producing ROCE.

Our Take On Bellway’s ROCE

Whereas returns have fallen for Bellway in latest instances, we’re inspired to see that gross sales are rising and that the enterprise is reinvesting in its operations. And there may very well be a chance right here if different metrics look good too, as a result of the inventory has declined 13% within the final 5 years. So we expect it might be worthwhile to look additional into this inventory given the developments look encouraging.

Like most corporations, Bellway does include some dangers, and we have discovered 2 warning signs that you need to be conscious of.

If you wish to seek for stable corporations with nice earnings, take a look at this free list of companies with good balance sheets and impressive returns on equity.

Have suggestions on this text? Involved concerning the content material? Get in touch with us straight. Alternatively, electronic mail editorial-team (at) simplywallst.com.

This text by Merely Wall St is normal in nature. We offer commentary based mostly on historic information and analyst forecasts solely utilizing an unbiased methodology and our articles aren’t meant to be monetary recommendation. It doesn’t represent a advice to purchase or promote any inventory, and doesn’t take account of your aims, or your monetary scenario. We goal to deliver you long-term targeted evaluation pushed by elementary information. Notice that our evaluation could not issue within the newest price-sensitive firm bulletins or qualitative materials. Merely Wall St has no place in any shares talked about.

[ad_2]

Source link