[ad_1]

For those who’re in search of a multi-bagger, there’s a couple of issues to maintain a watch out for. Firstly, we would wish to establish a rising return on capital employed (ROCE) after which alongside that, an ever-increasing base of capital employed. Mainly which means that an organization has worthwhile initiatives that it may proceed to reinvest in, which is a trait of a compounding machine. Talking of which, we seen some nice modifications in Daseke’s (NASDAQ:DSKE) returns on capital, so let’s take a look.

Understanding Return On Capital Employed (ROCE)

Simply to make clear when you’re uncertain, ROCE is a metric for evaluating how a lot pre-tax earnings (in proportion phrases) an organization earns on the capital invested in its enterprise. The components for this calculation on Daseke is:

Return on Capital Employed = Earnings Earlier than Curiosity and Tax (EBIT) ÷ (Complete Property – Present Liabilities)

0.12 = US$107m ÷ (US$1.1b – US$235m) (Based mostly on the trailing twelve months to March 2022).

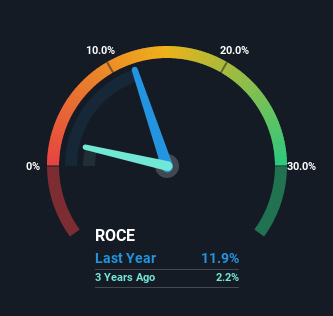

So, Daseke has an ROCE of 12%. That is a comparatively regular return on capital, and it is across the 14% generated by the Transportation business.

View our latest analysis for Daseke

Within the above chart we have now measured Daseke’s prior ROCE towards its prior efficiency, however the future is arguably extra necessary. For those who’re , you may view the analysts predictions in our free report on analyst forecasts for the company.

What Can We Inform From Daseke’s ROCE Development?

Daseke is displaying some optimistic developments. Over the past 5 years, returns on capital employed have risen considerably to 12%. Mainly the enterprise is incomes extra per greenback of capital invested and along with that, 64% extra capital is being employed now too. The growing returns on a rising quantity of capital is frequent amongst multi-baggers and that is why we’re impressed.

For the file although, there was a noticeable improve within the firm’s present liabilities over the interval, so we’d attribute a few of the ROCE progress to that. Primarily the enterprise now has suppliers or short-term collectors funding about 21% of its operations, which is not very best. Preserve a watch out for future will increase as a result of when the ratio of present liabilities to whole property will get significantly excessive, this could introduce some new dangers for the enterprise.

Our Take On Daseke’s ROCE

To sum it up, Daseke has confirmed it may reinvest within the enterprise and generate greater returns on that capital employed, which is terrific. Astute traders might have a possibility right here as a result of the inventory has declined 33% within the final 5 years. That being the case, analysis into the corporate’s present valuation metrics and future prospects appears becoming.

Daseke does have some dangers although, and we have noticed 2 warning signs for Daseke that you just may be all in favour of.

Whereas Daseke might not at the moment earn the very best returns, we have compiled a listing of corporations that at the moment earn greater than 25% return on fairness. Try this free list here.

Have suggestions on this text? Involved in regards to the content material? Get in touch with us instantly. Alternatively, electronic mail editorial-team (at) simplywallst.com.

This text by Merely Wall St is normal in nature. We offer commentary primarily based on historic knowledge and analyst forecasts solely utilizing an unbiased methodology and our articles are usually not supposed to be monetary recommendation. It doesn’t represent a advice to purchase or promote any inventory, and doesn’t take account of your goals, or your monetary state of affairs. We goal to convey you long-term targeted evaluation pushed by elementary knowledge. Notice that our evaluation might not issue within the newest price-sensitive firm bulletins or qualitative materials. Merely Wall St has no place in any shares talked about.

[ad_2]

Source link