[ad_1]

MajaPhoto/iStock Editorial through Getty Photos

In a recent article, I acknowledged traders ought to think about investing within the Montney pure gasoline play in western Canada, which is without doubt one of the world’s most important useful resource performs; I then went on to enumerate a set of E&P firms that will give traders publicity to that play, stopping wanting naming my finest picks amongst these shares.

Beneath, let’s first develop a easy but highly effective methodology for screening E&P shares after which use the approach to select the highest Montney pure-play shares.

Screening E&P Shares

“That is the persistent tendency of males to see solely the rapid results of a given coverage, or its results solely on a particular group, and to neglect to inquire what the long-run results of that coverage might be not solely on that particular group however on all teams. It’s the fallacy of overlooking secondary penalties.” – Henry Hazlitt

Widespread Potholes

This text is as a lot regarding how one can choose the perfect E&P shares as about presenting any particular concepts.

Power has been the perfect performing sector yr so far, as represented by SPDR S&P Oil & Fuel Exploration & Manufacturing ETF (NYSEARCA:XOP). Lots of new traders start to have a look at oil shares. A scientific methodology for screening power shares is extraordinarily vital for generalist traders who’re new to the oil and gasoline trade and, for that purpose, could fall for monofactorial decision-making.

- Monofactorial decisioning is the tendency for an investor to depend on one single issue to make a name on a moderately complicated funding thought, whereas ignoring quite a few different related variables.

Moreover, traders want a sound strategy to research E&P shares at present greater than ever, if solely to protect in opposition to the gunslinging gurus who emerge on social media in quantity because the oil costs rise and prod starry-eyed traders to chase on the spot riches by plowing hard-earned cash into shares that function the so-called torque, are heavily-indebted, and/or hedge an insufficient quantity of manufacturing.

- A believer in torque sniffs round for shares that supposedly ship the utmost upside because the oil costs swing greater. A standard catchphrase goes like “the inventory might be price Y when WTI reaches X”, which could be extraordinarily efficient in stoking unsophisticated purchaser’s creativeness of fast revenue. Torque peddlers hardly ever spell out the underlying assumption that the mannequin relies on a regularly rising oil worth; neither the perilous consequence when commodity costs inevitably flip in opposition to the holders of torquey shares.

A Holistic Strategy

At The Pure Assets Hub, we display screen for E&P concepts by analyzing plenty of operational parameters, and by integrating these variables in a holistic method. The worth of an oil and gasoline inventory is expressed as a product of a valuation metric, e.g., EV/E*, and a measure of the revenue, specifically E*:

The market accords a valuation a number of to a inventory relying on, e.g.:

- trade traits (e.g., cyclical or secular, rising or in terminal decline, ESG conforming or unpleasant),

- jurisdiction (fiscal regime, political stability, entry to infrastructure and expert labor),

- economics of the enterprise (e.g., subsurface useful resource endowment, whole commodity worth realization, and price construction),

- monetary well being of the enterprise (e.g., steadiness sheet high quality, commodity worth threat administration, and liquidity).

Additional increasing on what I first introduced in a previous interview, the revenue pulled in by a enterprise could also be described as follows:

- E* = {[Realized price] – [OpEx] – [F&D]} X [Production] X {1 + g}, the place OpEx is the full-cycle working bills, F&D is the associated fee to seek out and develop one barrel equal of oil and gasoline reserves, and g is the manufacturing progress charge.

The profitability of the enterprise can thus be described as E*/[Production] = {[Realized price] – [OpEx] – [F&D]} X {1 + g}, the place varied operational parameters come collectively to find out the profitability of a enterprise. This equation makes it doable to match totally different oil companies.

- A excessive [Realized price] has a optimistic impression on the profitability of the enterprise. This relies not solely on benchmark commodity costs but additionally on the composition of the manufacturing.

- The unfold [Realized price] – [OpEx] is the full-cycle working netback or margin. The ratio of working netback over F&D known as the recycle ratio.

- Manufacturing progress drives not solely improve in revenue but additionally economies of scale, unit OpEx decline and margin enlargement.

Analyzing Margins

Worth Realization

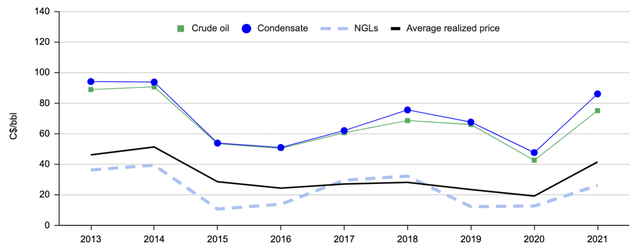

The share of crude oil and particularly condensate in whole manufacturing is the principle determinant of the worth realized by a Montney operator. Condensate captures a premium over crude oil as a result of there exists a robust demand for it from the Canadian oil sands producers. For instance, over the previous 9 years, ARC Assets (OTCPK:AETUF) achieved a condensate-over-oil premium of C$0.31/bbl to C$10.96/bbl, averaging C$3.96/bbl (Fig. 1).

Fig. 1. Historic costs of liquids manufacturing realized by ARC Assets (Laurentian Analysis based mostly on information sourced from Looking for Alpha and ARC Assets)

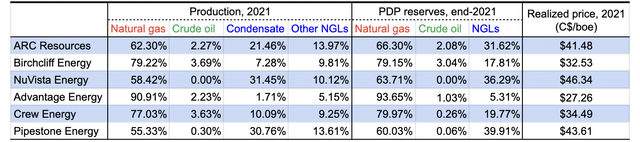

- It’s thus vital to match the Montney producers with regard to their composition of manufacturing. NuVista Power (OTCPK:NUVSF) and Pipestone Power (OTCPK:BKBEF) lead the pack in condensate + crude lower and, consequently, realized costs of whole manufacturing. ARC Assets shouldn’t be far behind, whereas Crew Power (OTCQB:CWEGF), Birchcliff Power (OTCPK:BIREF) and particularly Benefit Power (OTCPK:AAVVF) lag behind on this side (Desk 1).

Desk 1. The composition of manufacturing and PDP reserves of Montney pure-play E&P firms (Laurentian Analysis compiled from Looking for Alpha and firm monetary filings)

Working Prices

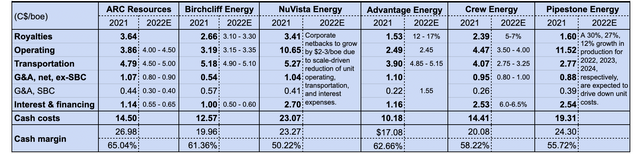

Benefit, ARC, Birchcliff and Crew had been price leaders in 2021, whereas NuVista and Pipestone had been excessive in unit money price (above C$19/boe). Between the realized worth and money prices, ARC, Pipestone and NuVista pulled within the highest money netbacks, with all six operators attaining a >50% money margin (Desk 2).

Nevertheless, the relative rating of margins of those firms could change within the close to future:

- Judging from the mid-point 2022 steerage, Benefit, ARC and Birchcliff are projected to have flattish to greater unit money prices this yr.

- NuVista, Crew and Pipestone are anticipated to scale back unit money price by means of manufacturing growth-driven economies of scale. NuVista plans to develop manufacturing by 30% in 2022 to refill its built-out infrastructure; Pipestone has an bold plan to hike manufacturing by 30%, 27%, and 12%, respectively, within the subsequent three years; and Crew intends to tug off a >20% manufacturing in 2022. Consequently, Pipestone and NuVista could pull forward in money margins within the subsequent few years.

Desk 2. Value construction and money margins of Montney pure-play E&P firms (Laurentian Analysis based mostly on information sourced from Looking for Alpha and firm monetary filings)

F&D Value And Recycle Ratio

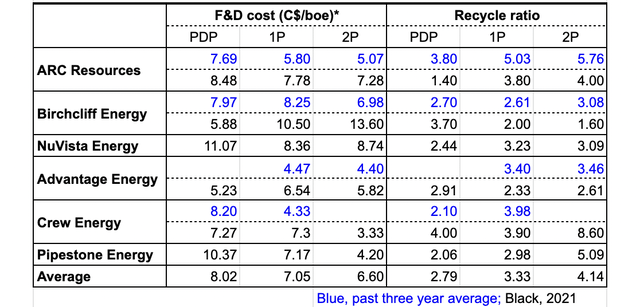

Benefit, Crew Power and ARC Assets appear to be barely forward of Birchcliff, NuVista and Pipestone when it comes to 1P F&D price and recycle ratio (Desk 3).

Desk 3. The F&D price and recycle ratio of Montney pure-play E&P firms (FD&A for Benefit) (Laurentian Analysis based mostly on information sourced from Looking for Alpha and firm monetary filings)

Measuring Development

Manufacturing Development

Barring the emerging Clearwater play participants, Montney pure-play E&P firms are maybe the quickest growers in Canadian oil and gasoline patch. For instance, ARC Assets was in a position to develop manufacturing at a CAGR of 15.4% from 2013 to 2021 and plans to additional develop output by an extra 13.4% in 2022.

- Pipestone and NuVista plan to develop manufacturing by some 30% this yr. Crew Power appears ahead to a 21% enlargement of its manufacturing.

- Benefit Power seems to put emphasis on an organic and/or acquisitive initiative to expand the weight of liquids, whereas retaining manufacturing progress at ~8% within the yr.

- Birchcliff appears to be content material with a flat manufacturing profile. It’s estimated to tug in C$920-940 million in free funds flow in 2022 from its unhedged manufacturing; nevertheless, it budgeted solely C$240-260 million of upstream capital expenditures, with a give attention to the redemption of all excellent series-A and series-C most popular shares by the tip of 3Q2022 and 0 whole debt by 4Q2022.

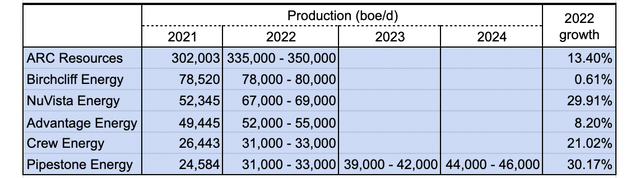

Desk 4. Manufacturing progress outlook of Montney pure-play E&P firms (Laurentian Analysis based mostly on information sourced from Looking for Alpha and firm monetary filings)

Reserves

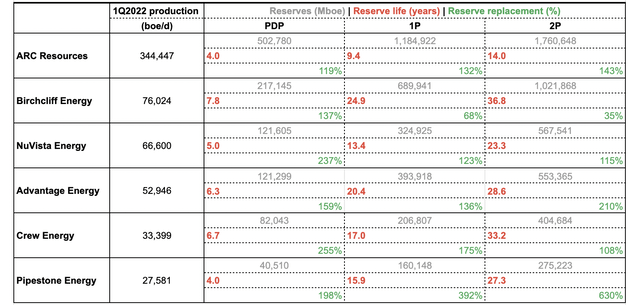

With out adequate reserve underpinning, a progress spurt could grow to be short-lived. It’s thus vital to match these Montney gamers when it comes to their respective reserve alternative ratio and reserve life.

- These six Montney pure-plays changed >119% of the PDP reserves depleted on account of manufacturing. Birchcliff could have failed to switch its 1P and 2P reserves (on account of significant technical revisions) however I’m not anxious because it has a moderately lengthy reserve life.

- These firms have >4 years of PDP reserve and >9 years of confirmed reserve backing, which in my view supply an sufficient progress runway. Apart from ARC Assets, the remainder of the pack have a >23 yr 2P reserve life (Desk 5).

Desk 5. Reserve life and 2021 reserve alternative if PDP, 1P and 2P reserves of pure-play Montney E&P firms (Laurentian Analysis based mostly on information sourced from Looking for Alpha and firm monetary filings)

Integrating Numerous Variables

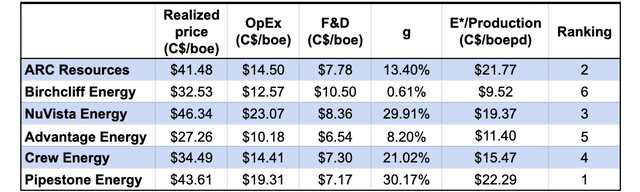

A barrel of oil equal manufacturing could generate various portions of revenue for various operators, relying on the mixture of operational variables as described within the afore-given equation. By way of profitability, the Montney pure-play shares are ranked in Desk 6.

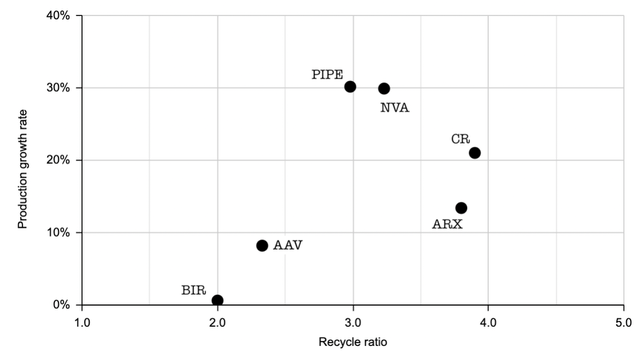

- That Pipestone, ARC and NuVista rank excessive is anticipated, contemplating their excessive profitability and speedy progress. It does not shock me both that Birchcliff ranks the bottom, given its low margins and near nil progress.

- The rating of Benefit in addition to Crew is negatively impacted by their low condensate lower and resultant low margins. To that finish, Crew Power intends to drive down its unit prices for greater margins; if economies of scale defeats inflation, the corporate could meet up with the rating of NuVista. Benefit is engaged on rising the burden of liquids in its manufacturing combine for higher worth realization and better margins (Fig. 2).

Desk 6. Rating the Montney pure-play E&P firms (Laurentian Analysis compiled from Looking for Alpha and firm monetary filings)

Fig. 2. Scatter plot of recycle ratio vs. manufacturing progress charge of Montney pure-play shares (Laurentian Analysis based mostly on information sourced from Looking for Alpha and firm monetary filings)

Relative Valuation

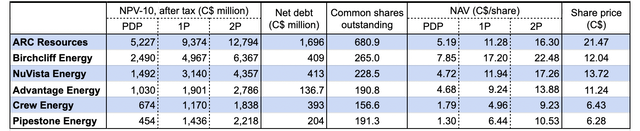

The Montney pure-play shares are in contrast in Desk 7 with regard to their reserves-based internet asset worth.

- By evaluating the share worth as of June 10, 2022, with the corresponding 1P NAV, we discover Birchcliff and Pipestone appear to be cheaper than the remainder of the pack, ARC Assets is clearly on the costly facet, and NuVista, Benefit and Crew are priced between their respective 1P and 2P NAV.

Desk 7. Per-share NAV of Montney pure-play shares, as in contrast with the present share costs (Laurentian Analysis based mostly on information sourced from Looking for Alpha and firm monetary filings)

Investor Takeaways

Power inventory pickers could observe the systematic, holistic technique as outlined on this article, with the advantage of dodging frequent potholes similar to monofactorial decisioning and avoiding being swayed by deceptive and complicated inventory promoters.

Our strategy results in plenty of findings concerning the Montney pure-play shares:

- Pipestone Power stands out with regard to asset high quality, progress prospect, and margin of security, whereas NuVista Power deserves an honorable point out.

- Birchcliff and Benefit don’t look like so spectacular when it comes to margins and progress outlook, regardless that the previous could seem low cost. Crew Power fares decently in margins and progress however it’s comparatively costly.

- ARC Assets has respectable margins and progress charge. Nevertheless, the inventory shouldn’t be low cost relative to friends, most likely because of its reputation amongst newly-arriving generalist traders who are inclined to gravitate towards large-cap names.

This inventory screening paves the way in which for additional in-depth examination of choose Montney pure-plays.

[ad_2]

Source link